Politicon.co

Bubbles of hope: role of tariffs on defueling optimism and risky borrowing in commodity-producing economies

During economic boom periods, commodity-producing countries often experience a surge in borrowing, particularly in foreign currencies, due to widespread optimism about future income growth. Both households and businesses in these economies usually tend to take excessive borrowing and risk due to being overly-optimistic about their future incomes and profits, assuming that high commodity prices, especially crude oil, will persist indefinitely. This overconfidence is particularly observed in the commodity producing economies in which borrowing in foreign currency is initially more affordable than taking debts in national currency. Once the oil price declines significantly, as seen during the 2014–2016 oil price crash when crude oil dropped below $60 per barrel, those economies encounter extreme financial distress. Depreciation of national currencies against US dollar makes the situation even more cumbersome, causing debt repayment to be increasingly difficult. As a result, the rise in overdue loans put significant pressure on banking sectors that were already vulnerable to foreign currency risks. A significant increase in overdue loans, also known as Non-Performing Loans (NPLs) triggers financial challenges in commodity-producing economies in the form of bank failures, capital flight, and declining investor confidence in national currencies. This makes the governments intervene often through costly bank bailouts, further straining public finances and increasing sovereign debt levels.

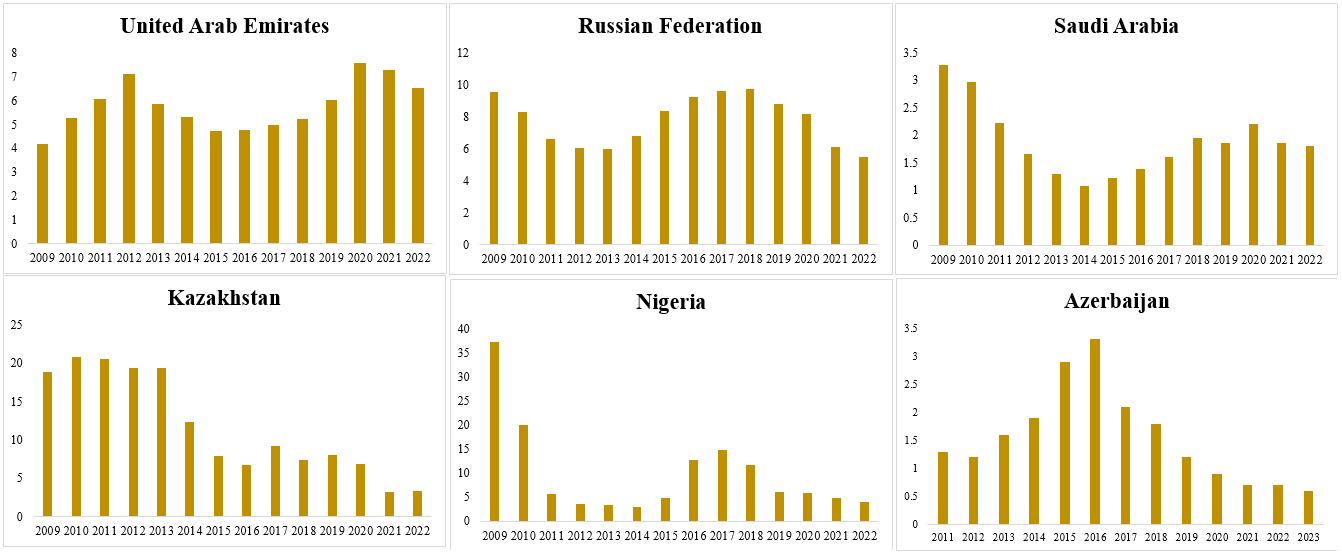

The channel through which the over-optimism leads to increase in overdue loans is the underestimation of repayment challenges or overestimation of business success. Optimistic borrowers assume that they will earn more income in the future, hence tend to borrow more today at the ongoing interest rate. Once the economy is hit by unexpected shocks and income becomes subject to severe volatility, they struggle to meet their repayment obligations, pushing loans into overdue status. In the case of entrepreneurs, they expect higher revenues for new ventures, making them borrow more aggressively and taking them excessive debt. In case their business fails or underperforms during recession or crisis, they default on loans, increasing the NPL ratio in banking sector and thus, deteriorating the financial stability so as economic growth at the end of the day. This situation was widely observed in the case of commodity producers during 2014-2016 oil price plunge which significantly declined the government revenue for countries like Azerbaijan, Russia, Kazakhstan, Saudi Arabia, United Arab Emirates, Nigeria, and other oil exporters, which is depicted in the Figure 1. From the dynamics of overdue loans, it can be seen that some of these countries like Azerbaijan, Russia, and Nigeria experienced the increase in overdue loans immediately during 2014-2016 oil price crisis, while others (UAE, Saudi Arabia, and Kazakhstan) observed it during post-crisis period.

Figure 1 Dynamics of Overdue Loans in Commodity-producing Economies

Source: World Bank Development Indicators

At the time of commodity boom, governments use borrowing in foreign currency not only as a way to stimulate economic growth but also as a tool for speculation. What makes the situation even more challenging is that loans are not protected from downside risk and once the oil price declines significantly, banks find themselves saddled with bad debt and inadequate capital buffers.

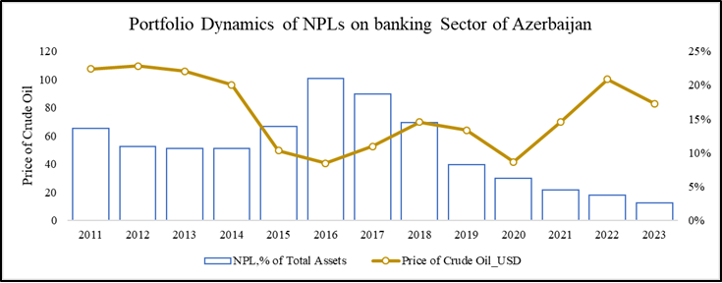

Figure 2: Portfolio Dynamics of NPLs on Banking Sector of Azerbaijan

Source: Author’s elaborations based on the data from Central Bank of Azerbaijan, Financial Stability Report 2023

The ramification is not only the financial distress but a rise in sovereign debt, often denominated in the same foreign currency that triggered the crisis to begin with. What commodity producing economies have to understand is that optimism during boom time is a risk factor that increases at the time of higher global trade uncertainty and commodity prices.

Once global conditions shift — whether due to geopolitical shocks, falling demand, or trade restrictions — the fragile logic of this optimism collapses. The connection between tariffs and household debt may seem indirect. But for oil-exporting nations, it's all too real. Tariffs reduce oil prices and create uncertainty, undermining the overly optimistic sentiment in commodity-producing economies. This limits risky foreign currency borrowing — not because policymakers act prudently, but because uncertainty suppresses confidence.

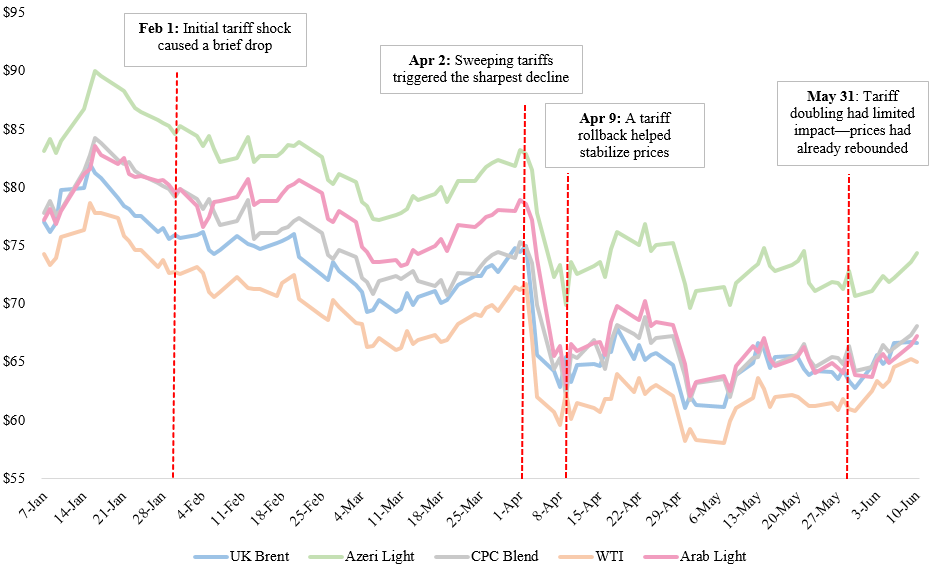

Figure 3: Crude Oil Price Trends Around 2025 Tariff Announcements

Source: Author’s work based on data from https://oilprice.com/oil-price-charts/

Implemented energy tariffs imply that there is a high likelihood for the significant decline in the global commodity prices, which spreads volatility as the major oil-exporting economies adjust their production and supply chain. Nations heavily relying on commodity income encounter the challenges in creditworthiness, budget planning as well as business sentiment. This is how tariffs reshape the financial behavior of households and governments. As illustrated in the figure, tariff announcements triggered sharp declines in oil prices across major benchmarks — UK Brent, WTI, Arab Light, and more. It turns out that today's tariff-driven uncertainty disrupts the cycle of overconfidence, unlike prior periods when optimism fueled reckless borrowing. This makes borrowing in foreign currency more cautious, not thanks to improved policies but due to the uncertainty suppresses sentiment.

While tariffs can block the overconfidence during the short-term, it exposes deep vulnerability as commodity exporters still remain exposed to both global demand patterns and external shocks. In the absence of sustainable fiscal buffers, financial oversight, and diversified economy, tariffs may interrupt not only optimism but reveal how fragile the underlying economic assumptions really are.

![]()

- TAGS :