Politicon.co

Growing Concerns about the Turkish Economic Growth

Back in the summer of 2018, I was a research intern at the Center for Economic and Social Policy in Baku. It was a Friday afternoon. I was sitting in the office and watching the announcement of a new economic policy package by Berat Albayrak, Minister of Treasury and Finance of Turkey.

Turkish Lira back then was depreciating and following Albayrak’s speech it continued to lose value at a faster rate; on Monday, the opening rate of Turkish Lira against USD exceeded 7.0. The ministerial speech did not meet the expectations of people. One could see that the structural reforms in the new policy package was one of the leading reasons for the failure of people’s expectations and had a huge negative impact on the already weak Turkish Lira.

To understand the past and present trends in the Turkish economy one must analyze the economy from the long-run structural economic framework. Labor force participation, gender gap, democracy, central bank independence, education and justice systems are among those elements that constitute the structural analysis framework.

The first glance

.png)

Figure 1 1

The first glance at the Turkish Gross Domestic Product suggests dramatic growth from 1980 till now (Figure 1). However, it is important to break down Figure 1 into three parts to sense the changing dynamics in the GDP growth over these years.

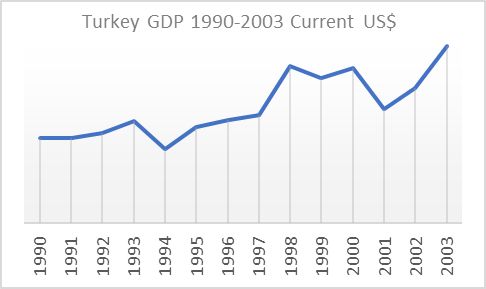

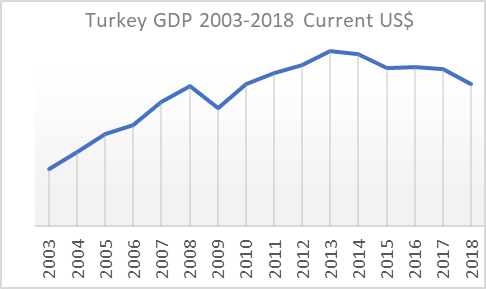

Figure 2&3, respectively 2

Figure 2 illustrates the evolution of Turkish GDP over 1990–2003. Throughout the 1990s Turkish economy experienced several V-shaped recessions and the overall performance of the economy was weaker than the period after 2001. Although the Turkish economy in the '90s is not a focal point of this article, to understand the economic impact of structural reforms in the early 21st century observing economic performance in the absence of those reforms is useful.

In the early 21st century several structural reforms had been introduced and applied very well. The collapse of the national banking system made Turkey approach to the IMF. Economic policy packages had been prepared by Turkish bureaucrats and economists. The structural reforms of the justice system, government accountability and transparency, etc. had been carried out. The Turkish banking sector had been restructured and the central bank gained independence.

Moreover, after 2002 the democratically elected government decreased the political fragmentations and uncertainty which led to the efficient implementation of structural reforms. Consequently, Turkish economic performance improved significantly, and a comparatively balanced economic growth path had been established.

Vicious cycle

Nonetheless, Turkey’s economic performance trend after 2003 has been anything but monotonous. The economy was able to recover from the Great Recession quickly (with immense contributions by the Central Bank of Turkey) but started to stagnate after 2013. In the absence of sound economic policies, Turkish Lira started to depreciate, unemployment increased over time and now remains high, while the inflation rate jumped to the two-digit levels whereas its target level constitutes 5 percent.

The credibility of the Central Bank fell due to the constant failures in inflation targeting and increased government interventions to the Central Bank of Turkey. Dismissal of its chairman in July 2019 and the resignation of several other brilliant monetary economists indicate the scope of the government infringements on the independence of the Central Bank. Henceforth “the vicious cycle” was created, contributing to inflation rate remaining in the double-digit area.

“The heat”

However, after 2013, the populist policies pursued by the ruling conservative-democratic AK party led to credit expansions and increased share of state-owned banks. The establishment of the Credit Guarantee Fund made credits for small and medium-sized enterprises (SMEs) accessible. The state-owned banks hold a great role in this process. Figure 4 shows that in 2008, the share of SME loans by state-owned banks in total SME loans was below 20%, however, in 2018 it constituted 35.2%. SME loans by state-owned banks continued to accumulate even after the 2018 crisis and reached the level 240.865 billion TL in 2019 (till October), or 40% of the aggregate SME loans. It is quite problematic to view this loan expansion as a healthy process since the privately-owned and foreign banks decreased their SME loans after 2018 considering the growing risks of loan failure.

.png)

Figure 4 3

Increased credit expansion by the state-owned banks led to the overheating economy since the economic policies implemented did not intend to increase “the heat level” under which the economy could grow sustainably. In other words, in the absence of long-term structural reforms, short-term growth mechanisms such as credit expansion led by state-owned banks concluded with the overheating economy. Short-term remedies could not cure the long-term illnesses of the Turkish economy.

The fast pace of the economy which was not controlled by “breaks” of the Central Bank, made the economy’s crash against the rocks unavoidable. Turkish Lira sharply depreciated in the summer of 2018. Banks had to increase their provisions (defined as money set aside from the bank’s equity to cover the probable, but an uncertain failure of a bank’s loans), which melted some proportion of banks’ equities down.

The legitimacy of the vicious cycle

Investigating the intentions behind the demand-side fiscal policies (government expenditures) is important to understand the high inflation levels and lack of investment to boost the potential economy. Professor Refet Gürkaynak and Selin Sayek Böke in their article named “Turkish Economy under the AKP Rule”, argue that there is a high correlation between economic performance under the AKP rule and election results. The popularity of the ruling party is traditionally assisted by economic performance. Gürkaynak and Böke indicated that government spending increased during the 2009 crisis to prevent the long-term recession; nonetheless, demand-side expenditures did not decrease after 2009. Although the government's economic policies after the Great Recession did not serve to the increment of the economy’s potential and led to overheating economy with high inflation rates, they enabled it to stay in power comfortably and uphold the popularity that was gained after the exemplary implementation of the IMF program throughout 2002-2006. Henceforth, one can deduce that the economic policies implemented after the 2009 crisis were not only the choice of government, but of the people as well. Under democratically held elections AKP managed to stay in power. However, one may ask that why people still continue to endorse these measures if they resulted in economic problems such as high inflation, depreciated Turkish lira, etc.

Societal preferences are being shaped and formed by the level of education in society. Assessing the education level and its role in people’s social, economic, and political decisions requires a complicated line of thought. Numbers such as tertiary education enrollment ratios, years of schooling, rankings of country’s higher education institutes may not be enough to capture the quality of education and its impact on society’s preferences completely. However, these data can be utilized for comparison with other countries, hence, they have an explanatory power to understand societal preferences.

The tertiary education enrollment ratio in Turkey is 20.8% percent among 15- to 64- year old persons. Among 36 OECD member countries, Turkey outstrips only Mexico, South Africa and Italy.4 Tertiary education spending per person in Turkey is 8901 USD which makes Turkey 29th among OECD members. The 44.8% of women in the age group between 20 and 24 are not in employment, education or any training. The PISA scores which “measure the scientific literacy of a 15-year-old in the use of scientific knowledge to identify questions, acquire new knowledge, explain scientific phenomena, and draw evidence-based conclusions about science-related issues” show that Turkey’s score in science, mathematics, and reading literacy are 468, 454, and 466, respectively where the OECD average is 489, 489, and 487, respectively.

OECD data5 that depict the basic education level in Turkey is still capable of explaining the relatively weak education conditions in Turkey. Given these conditions, the ease with which the economic policies described above were so successful in gaining legitimacy of people is more understandable. Popularity of demand-side fiscal policies which led to the overheating economy, structural unemployment, and weak currency as I discussed above is justified by the low average level of education of people in Turkey.

“Səs salma, yatanlar ayılar, qoy hələ yatsın” - “Don’t make any noise, don’t let the nation wake up.”

Another structural problem leading to the stagnation in the Turkish economic growth after 2013 can be observed through the employment statistics.

.png)

Table 17

Albeit the number of people who are eligible to work was 61.469 million (Table 1) in 2019, the labor force which contains the number of employed and unemployed people (people who do not work and are seeking jobs) is 32.549 million. It is a 53.0% labor force participation rate. The low labor force participation rate is structurally deepened by the gender differences in employment. In 2019 there were 11.359 million people who are not in the labor force and claim to be fully preoccupied with house duties. Practically 100% of them are women. Considering the potential contribution of those women to the economy, one might argue the growth capacity of Turkish economy is systematically underused. Nonetheless, one should also consider that maybe the growth capacity ought to be defined not based the outcomes of people’s possible preferences that are nor realized, but the existing ones. After all, participation in the labor force is a preference.

Past and Future

If we look at the evolution of GDP over a sufficiently long time, we will be able to see a country’s starting point and also where she headed over this time. According to the famous economist Robert Barro, initial efficiency, technology and capital per worker set the starting point of a country’s growth path. However, fundamentals such as economic policy determine where the country is headed.

We cannot change the past, but we can set the future with the assistance of good economic policies. Investigating the trends in the Turkish economy over recent decades helps us to observe how the structural economic policies set the growth path of a country and how unavoidable the consequences of ignoring structural reforms are, both in the long-run and in the short-run.

References

[1] Source: World Bank

[2] Source: World Bank

[3] Source: BRSA

[4] Data is taken from the OECD webpage and illustrates the results in 2018

[5] It must be noted that a broader data range is required to assess deeper concepts such as academic freedom and a regional difference in the quality of education.

[6] Taken from Azerbaijani poet M. A. Sabir’s poem named “Uchiteller” (Teachers)

[7] Source - TUIK

![]()

- TOPICS :

- Economy

- REGIONS :

- Middle East and North Africa